The S&P 500 has dropped nearly 15% from its peak earlier this year, edging closer to the threshold of a bear market. While overhauling your investment portfolio in anticipation of a bear market is rarely a sound move, market downturns do bring unique opportunities. Below’s a breakdown of how to capitalize on these chances—and what mistakes to avoid—when stocks are sliding.

1. Steer Clear of Market Timing

Trying to time investments in a declining market is often compared to “catching a falling knife”—risky and rarely successful. Instead of aiming to pinpoint the exact market bottom, maintain regular, consistent investments as stocks fall. If market swings become extremely volatile, stepping up the frequency of your contributions can make sense: for instance, if you usually invest monthly, consider switching to weekly contributions during periods of high turbulence.

Historically, putting more money into the market while it’s down tends to yield better long-term results. If you have the means to boost your contributions, it’s worth considering—but keep in mind that no one can predict how far the market will drop or when it will rebound. This is why regular, incremental contributions are better than dumping a lump sum all at once. Timing the bottom might pay off occasionally, but what if the market plummets another 30% right after you invest a large amount? A strategy called dollar-cost averaging—spreading out your investments over time—can help soften the blow of market volatility on your portfolio.

It’s also worth noting that stock market declines (and bear markets) often coincide with other economic hardships, such as rising unemployment. If you haven’t yet built a full emergency fund, now is an ideal time to start.

2. Capitalize on Tax-Loss Harvesting in Taxable Accounts

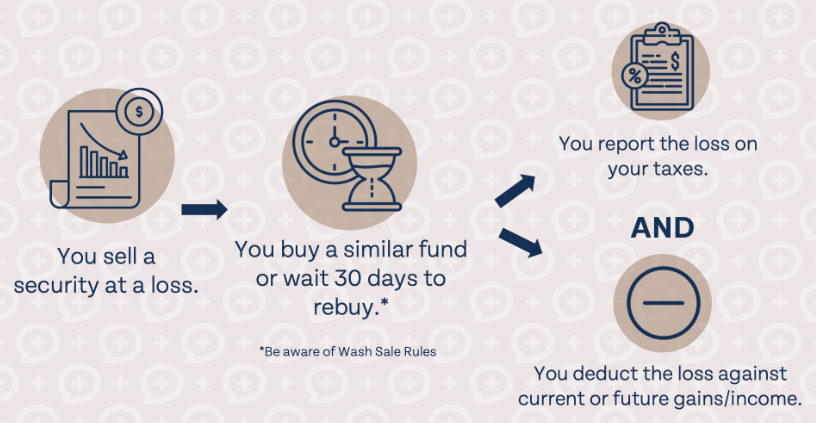

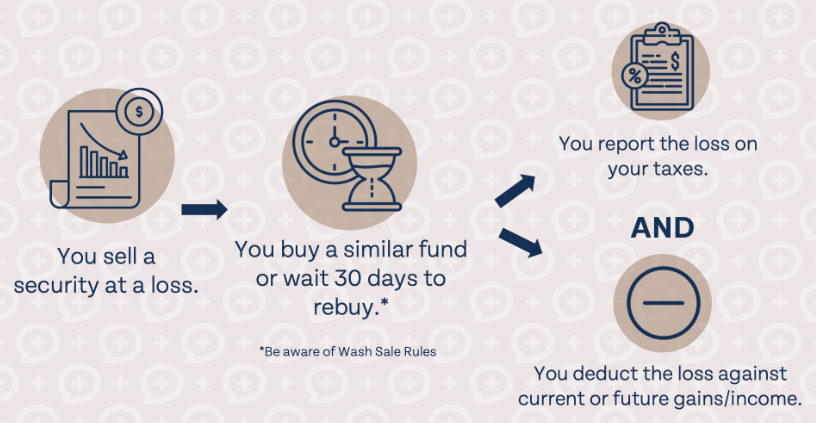

One silver lining of a market downturn is the chance to engage in tax-loss harvesting—but this strategy only works in taxable investment accounts. Investments held in tax-advantaged accounts like Roth IRAs or 401(k)s are exempt from capital gains taxes, so there’s no benefit to harvesting losses there. In taxable accounts, however, this tactic can lower your tax bill.

Here’s how it works: When you sell an investment at a loss, you “lock in” that loss, which you can then report on your tax return to offset future capital gains or even some types of income. A critical rule to remember is the wash-sale rule: If you reinvest in the same or a nearly identical security within 30 calendar days before or after the sale, you won’t be able to use that loss for tax purposes.

3. Reassess Your Investment Strategy

While a market downturn alone shouldn’t prompt major overhauls to your investment strategy, it’s an excellent time to review your approach. If you feel your portfolio has dropped more sharply than it should have, compare its performance to a target-date index fund that aligns with your retirement timeline. For example, if a target-date fund close to your retirement year is down 10%, but your portfolio has fallen 50%, it may be time to rethink the level of risk you’re taking on.

Diversification is one of those strategies that feels irrelevant until you need it. When certain market sectors are outperforming, diversification can seem like a drag on returns. But when some sectors crash harder than others, spreading your investments across a broad range of assets ensures your portfolio doesn’t bear the full brunt of those losses.

4. Focus on Contributions, Not Investment Returns

Checking your investments is exciting when the market is rising—but far less so when stocks are falling. If you’re contributing to your portfolio monthly but still seeing its overall value drop, it’s easy to feel like your money isn’t making a difference. During downturns, shift your focus from the current value of your investments to how much you’ve put into the market and how many shares you own. You can’t control which direction the stock market moves, but you can control how much you contribute and how many shares you accumulate.

A little over a week ago, the CNN Fear and Greed Index hit 3—out of 100, not 10—placing it firmly in “extreme fear” territory. Stock market declines are unsettling, even for experienced investors. Instead of fixating on what you can’t control during a downturn, focus on actionable steps: avoid trying to time the bottom, use the decline to harvest losses in taxable accounts, reassess your strategy (without making unnecessary changes), and track your contributions and share count rather than just your portfolio’s ups and downs.

Home

detail

What To Do When the Stock Market Is Down

2025-09-16T16:53:15

The S&P 500 has dropped nearly 15% from its peak earlier this year, edging closer to the threshold of a bear market. While overhauling your investment portfolio in anticipation of a bear market is rarely a sound move, market downturns do bring unique opportunities. Below’s a breakdown of how to capitalize on these chances—and what mistakes to avoid—when stocks are sliding.

1. Steer Clear of Market Timing

Trying to time investments in a declining market is often compared to “catching a falling knife”—risky and rarely successful. Instead of aiming to pinpoint the exact market bottom, maintain regular, consistent investments as stocks fall. If market swings become extremely volatile, stepping up the frequency of your contributions can make sense: for instance, if you usually invest monthly, consider switching to weekly contributions during periods of high turbulence.

Historically, putting more money into the market while it’s down tends to yield better long-term results. If you have the means to boost your contributions, it’s worth considering—but keep in mind that no one can predict how far the market will drop or when it will rebound. This is why regular, incremental contributions are better than dumping a lump sum all at once. Timing the bottom might pay off occasionally, but what if the market plummets another 30% right after you invest a large amount? A strategy called dollar-cost averaging—spreading out your investments over time—can help soften the blow of market volatility on your portfolio.

It’s also worth noting that stock market declines (and bear markets) often coincide with other economic hardships, such as rising unemployment. If you haven’t yet built a full emergency fund, now is an ideal time to start.

2. Capitalize on Tax-Loss Harvesting in Taxable Accounts

One silver lining of a market downturn is the chance to engage in tax-loss harvesting—but this strategy only works in taxable investment accounts. Investments held in tax-advantaged accounts like Roth IRAs or 401(k)s are exempt from capital gains taxes, so there’s no benefit to harvesting losses there. In taxable accounts, however, this tactic can lower your tax bill.

Here’s how it works: When you sell an investment at a loss, you “lock in” that loss, which you can then report on your tax return to offset future capital gains or even some types of income. A critical rule to remember is the wash-sale rule: If you reinvest in the same or a nearly identical security within 30 calendar days before or after the sale, you won’t be able to use that loss for tax purposes.

3. Reassess Your Investment Strategy

While a market downturn alone shouldn’t prompt major overhauls to your investment strategy, it’s an excellent time to review your approach. If you feel your portfolio has dropped more sharply than it should have, compare its performance to a target-date index fund that aligns with your retirement timeline. For example, if a target-date fund close to your retirement year is down 10%, but your portfolio has fallen 50%, it may be time to rethink the level of risk you’re taking on.

Diversification is one of those strategies that feels irrelevant until you need it. When certain market sectors are outperforming, diversification can seem like a drag on returns. But when some sectors crash harder than others, spreading your investments across a broad range of assets ensures your portfolio doesn’t bear the full brunt of those losses.

4. Focus on Contributions, Not Investment Returns

Checking your investments is exciting when the market is rising—but far less so when stocks are falling. If you’re contributing to your portfolio monthly but still seeing its overall value drop, it’s easy to feel like your money isn’t making a difference. During downturns, shift your focus from the current value of your investments to how much you’ve put into the market and how many shares you own. You can’t control which direction the stock market moves, but you can control how much you contribute and how many shares you accumulate.

A little over a week ago, the CNN Fear and Greed Index hit 3—out of 100, not 10—placing it firmly in “extreme fear” territory. Stock market declines are unsettling, even for experienced investors. Instead of fixating on what you can’t control during a downturn, focus on actionable steps: avoid trying to time the bottom, use the decline to harvest losses in taxable accounts, reassess your strategy (without making unnecessary changes), and track your contributions and share count rather than just your portfolio’s ups and downs.