Believe it or not, the concept of saving for retirement hasn’t been around that long. Our financial expert Brian is even older than the 401(k) plan. Previous generations either worked until they passed away, relied on Social Security, or were lucky enough to have pensions that covered most or even all of their retirement expenses. Today, only 15% of private-sector employees have access to pensions. The shift of retirement savings responsibility from employers to employees hasn’t been easily accepted. 83% of Americans believe everyone should have access to a pension, 79% think we’re facing a retirement crisis, and 55% are worried about their retirement.

How do you know how much savings you need to enjoy a comfortable retirement? Will Social Security be enough? How should you handle inflation and investment returns? This article will teach you how to estimate your retirement needs, giving you more peace of mind about unknown factors like Social Security, investment gains, and inflation.

How Much Money Do You Need to Retire?

It shouldn’t come as a surprise, but there’s no magic retirement savings target that everyone should aim for. Your retirement funds depend on many different factors.

– How much do you plan to spend in retirement?

While it’s hard to predict retirement expenses accurately, you can estimate your future retirement spending. Try adjusting your current spending level to match what you’ll need in retirement. If you’re unsure about the inflation rate, start with 3%. You can use free online calculators to estimate retirement expenses. If you know certain costs will disappear after retirement—such as a mortgage—deduct those from your current expenses. This estimate may not be perfect, but it can provide a reference for determining how much money you’ll need in retirement.

– Will you rely on fixed income in retirement?

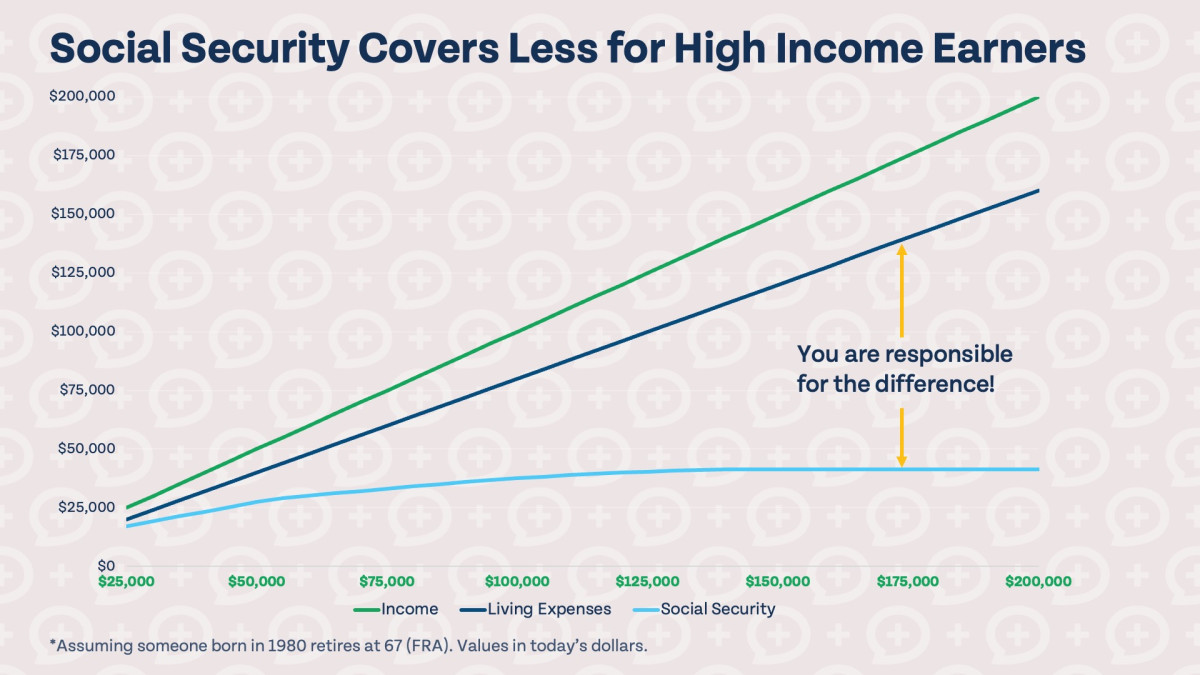

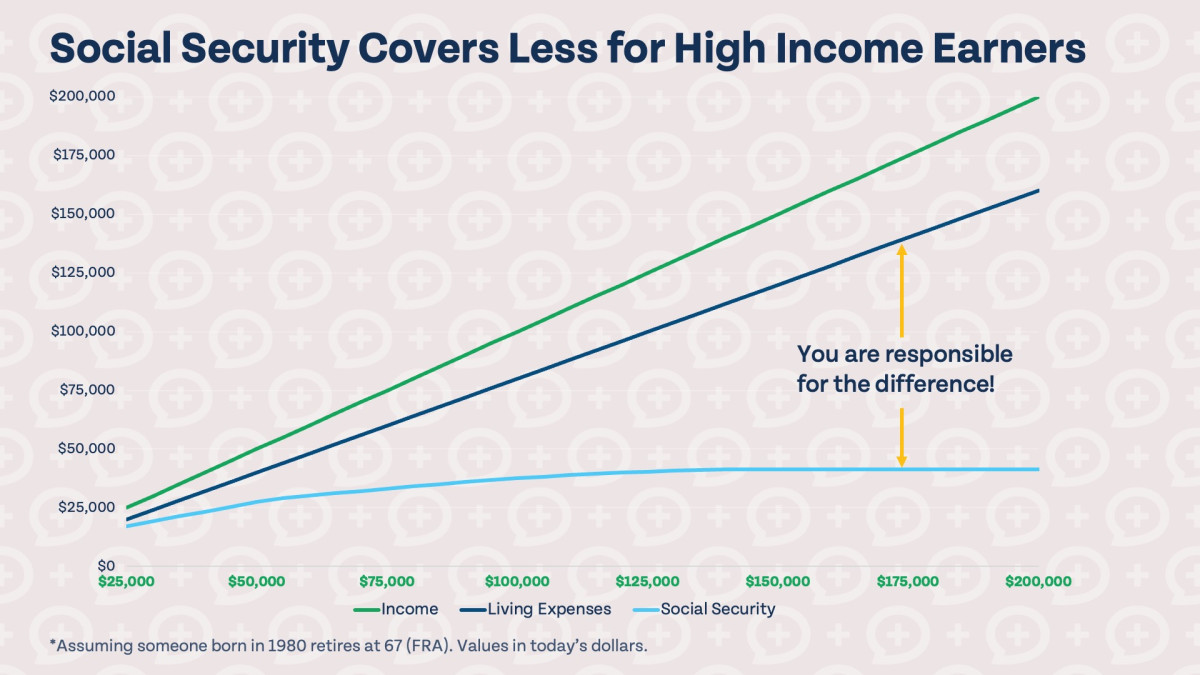

If you’re decades away from retirement, it’s best not to count on Social Security for now. For those expecting to receive Social Security benefits, the payments may only cover a small portion of your living expenses (see the table below). Do you anticipate other fixed income sources in retirement, such as a pension? Be sure to include these incomes in your retirement needs assessment.

– How will inflation and market returns change?

We can’t accurately predict inflation rates or market returns between now and your retirement, but we can make estimates based on historical data. It’s wise to use conservative projections for both investment returns and inflation—would you rather have too much money in retirement or too little?

– When do you plan to retire?

You may already have a rough idea of your ideal retirement age, especially as you get closer to it, but this number can change. Be prepared for unexpected circumstances. What if you retire earlier or later than planned?

– How long will you live?

No one likes to predict their lifespan, but when it comes to retirement investments, it’s best to assume you’ll live a long and healthy life—unless there’s strong evidence to the contrary. In general, leaving an inheritance for your loved ones is far better than outliving your savings.

How Much Should You Save Before Retirement?

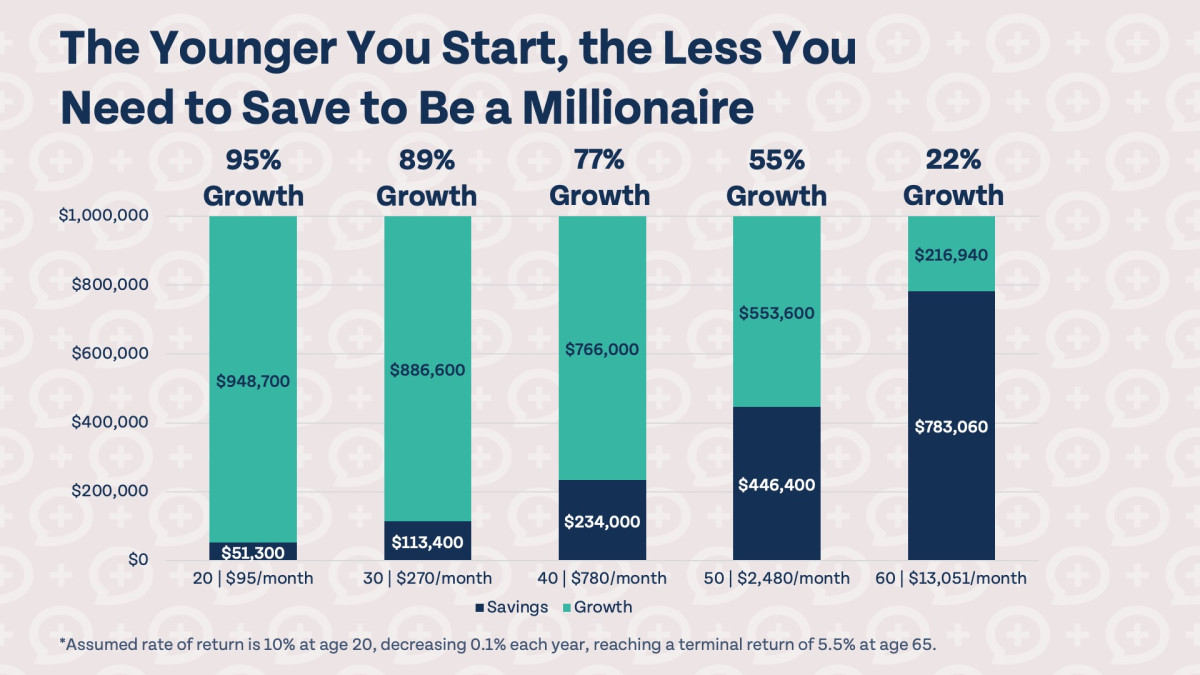

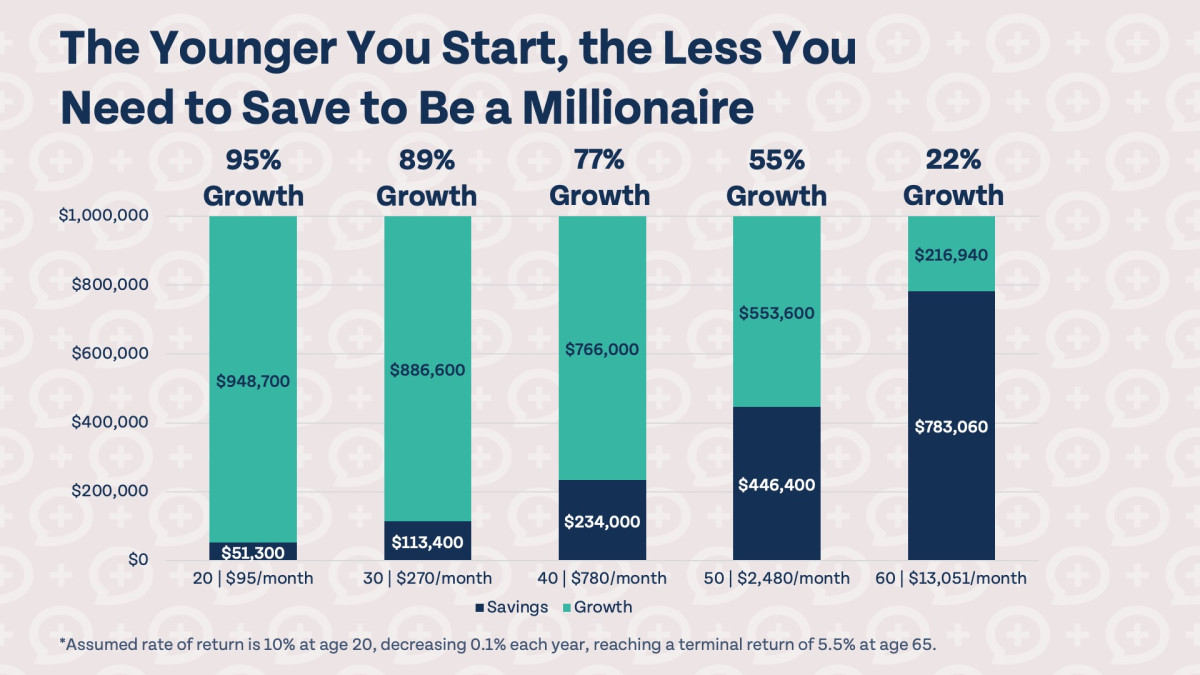

Once you have a rough idea of how much money you’ll need in retirement, you can determine how much you need to invest to reach that goal. The good news is that if you start investing when you’re young, you’ll need to put away much less. If you start investing at 20 and want to have $1 million by 65, you’ll only need to invest $95 per month (assuming a 10% return on investment). But if you wait until 50 to start, your monthly investment will soar to $2,480 (assuming a 7% return on investment). The earlier you start investing, the more grateful your future self will be—imagine your retired self giving you a big, enthusiastic hug.

Calculating retirement savings is not an exact science, as the future is unpredictable. Many things can change between now and your retirement. Some factors are within your control—such as how much you invest, when you retire, and your post-retirement spending—but variables like inflation and investment return rates are not. A good retirement plan isn’t about knowing all the unknowns; it’s about planning ahead and designing a strategy that can succeed without over-reliance on those uncertainties.

Home

detail

How Much Do You Actually Need To Retire?

2025-11-14T15:34:34

Believe it or not, the concept of saving for retirement hasn’t been around that long. Our financial expert Brian is even older than the 401(k) plan. Previous generations either worked until they passed away, relied on Social Security, or were lucky enough to have pensions that covered most or even all of their retirement expenses. Today, only 15% of private-sector employees have access to pensions. The shift of retirement savings responsibility from employers to employees hasn’t been easily accepted. 83% of Americans believe everyone should have access to a pension, 79% think we’re facing a retirement crisis, and 55% are worried about their retirement.

How do you know how much savings you need to enjoy a comfortable retirement? Will Social Security be enough? How should you handle inflation and investment returns? This article will teach you how to estimate your retirement needs, giving you more peace of mind about unknown factors like Social Security, investment gains, and inflation.

How Much Money Do You Need to Retire?

It shouldn’t come as a surprise, but there’s no magic retirement savings target that everyone should aim for. Your retirement funds depend on many different factors.

– How much do you plan to spend in retirement?

While it’s hard to predict retirement expenses accurately, you can estimate your future retirement spending. Try adjusting your current spending level to match what you’ll need in retirement. If you’re unsure about the inflation rate, start with 3%. You can use free online calculators to estimate retirement expenses. If you know certain costs will disappear after retirement—such as a mortgage—deduct those from your current expenses. This estimate may not be perfect, but it can provide a reference for determining how much money you’ll need in retirement.

– Will you rely on fixed income in retirement?

If you’re decades away from retirement, it’s best not to count on Social Security for now. For those expecting to receive Social Security benefits, the payments may only cover a small portion of your living expenses (see the table below). Do you anticipate other fixed income sources in retirement, such as a pension? Be sure to include these incomes in your retirement needs assessment.

– How will inflation and market returns change?

We can’t accurately predict inflation rates or market returns between now and your retirement, but we can make estimates based on historical data. It’s wise to use conservative projections for both investment returns and inflation—would you rather have too much money in retirement or too little?

– When do you plan to retire?

You may already have a rough idea of your ideal retirement age, especially as you get closer to it, but this number can change. Be prepared for unexpected circumstances. What if you retire earlier or later than planned?

– How long will you live?

No one likes to predict their lifespan, but when it comes to retirement investments, it’s best to assume you’ll live a long and healthy life—unless there’s strong evidence to the contrary. In general, leaving an inheritance for your loved ones is far better than outliving your savings.

How Much Should You Save Before Retirement?

Once you have a rough idea of how much money you’ll need in retirement, you can determine how much you need to invest to reach that goal. The good news is that if you start investing when you’re young, you’ll need to put away much less. If you start investing at 20 and want to have $1 million by 65, you’ll only need to invest $95 per month (assuming a 10% return on investment). But if you wait until 50 to start, your monthly investment will soar to $2,480 (assuming a 7% return on investment). The earlier you start investing, the more grateful your future self will be—imagine your retired self giving you a big, enthusiastic hug.

Calculating retirement savings is not an exact science, as the future is unpredictable. Many things can change between now and your retirement. Some factors are within your control—such as how much you invest, when you retire, and your post-retirement spending—but variables like inflation and investment return rates are not. A good retirement plan isn’t about knowing all the unknowns; it’s about planning ahead and designing a strategy that can succeed without over-reliance on those uncertainties.