Losing or leaving a job can be an extremely stressful experience, even if you’ve taken all possible steps to prepare. That said, the more you do to save money and boost your self-sufficiency now, the easier it will be to get through an unstable economic period and come out on top.

How to Get Your Finances Ready for Job Loss

Most of the time, people don’t see a job loss coming—it hits as an unwelcome surprise. Luckily, there are plenty of steps you can take right now to prepare for potential layoffs or a significant cut in working hours.

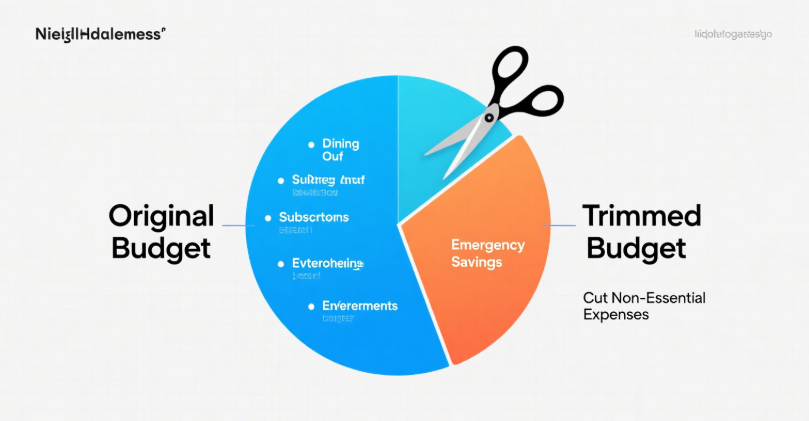

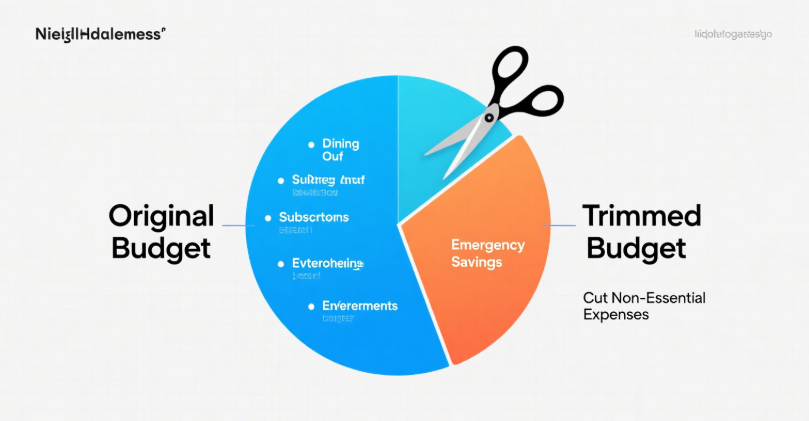

1. Adjust and Cut Back Your Budget

If you’re worried about job loss and don’t have a monthly household budget, create one right away. If your current budget is based on your old income, go through it and reevaluate your expenses to fit your possible new situation.

Trim as much as you can from your spending. Ideas for saving money on a tight budget include:

- Canceling cable and switching to cheaper streaming services like Disney+, Amazon Prime Video, Hulu, or Netflix.

- Raising your car and home insurance deductibles to lower your monthly premiums.

- Cutting off any subscriptions—magazines, streaming services, or subscription boxes—and using tools like Truebill to spot forgotten ones you’re still paying for.

- Keeping the AC off or the heat turned down to save on utility bills.

- Turning off lights to reduce your electric bill.

If you’re worried about affording essential services like electricity, internet, gas, or water amid the ongoing pandemic, call your provider and explain your situation. USA Today reports that many cities and private companies are pausing service disconnections for nonpayment, waiving late fees, offering flexible payment plans, or even letting customers delay payments entirely.

2. Build Up Your Emergency Fund

If you don’t have an emergency fund yet, learn how to start one by putting money into a high-yield savings account—banks like CIT Bank offer good options. If you already have one, make sure it covers 3–6 months of your family’s expenses. Whenever possible, put every dollar you cut from your budget straight into this fund.

Chances are the pandemic has changed your daily life significantly—and like most people, you’re probably not doing many of the things you used to. While it might feel frustrating to give up these activities or purchases, they’re a chance to grow your emergency fund further.

Think about everything you used to do before the pandemic that you’re not doing now, and redirect that money to your fund. For example:

- Going out for drinks with coworkers after work

- Dining out at restaurants

- Attending concerts or sports games

- Taking vacations

- Buying new clothes

- Grabbing a latte before work

If you’re working from home during the pandemic, for instance, you’re not spending money on gas for your commute—start putting that weekly gas money into your emergency fund. Or if you used to spend $25 a week on lunch with colleagues, add that to the fund too.

You could also use your tax refund to build the fund, or the stimulus checks the federal government issued in response to the pandemic. CNBC notes that the federal government planned to send $1,200 checks to most Americans within a few weeks [at the time of writing]. If you don’t need this money for rent, mortgage, or groceries, use it to kick-start your emergency fund.

3. Plan for Health Insurance

According to the Kaiser Family Foundation, 49% of Americans get their health insurance through their employer. So what happens if you lose your job?

First, if you get a severance package, read the details carefully to see if you can sign up for COBRA—a group insurance plan your employer may offer if you’ve been laid off or had your hours cut.

You can also apply for coverage through the federal government’s health insurance marketplace. Job loss counts as a “life change” that qualifies you for special enrollment, so you can apply even if open enrollment is closed.

You might also qualify for Medicaid—each state has its own requirements based on income and family size. If there’s a cash-only doctor in your area, that’s another option: many charge a flat monthly fee for unlimited services like office visits or phone consultations, with the fee depending on your location and family size.

4. Pay Down Debt

Getting out of debt—especially high-interest debt—should be a top priority before losing your job, and there are ways to tackle credit card debt quickly. Do what you can to pay off current debt, or transfer high-interest debt to a credit card with a lower APR. If you’re still employed, find ways to earn extra income now and use that to pay down debt.

You could also contact your credit card company to explain your situation. The New York Times reports that some lenders are offering temporary hardship help, like letting you make interest-only payments, waiving interest entirely, or even pausing payments for a set time.

If you own a home and have good credit, consider applying for a home equity line of credit (HELOC) before losing your job—it can be hard or impossible to get one once you’re unemployed. You don’t have to use the funds right away, but it gives you access to cash for paying off high-interest credit cards or buying groceries.

U.S. News & World Report notes that using a HELOC to pay off credit card debt can lower interest payments significantly. But keep in mind: if you default on the HELOC, you risk losing your home, so weigh the pros and cons carefully.

Some credit cards currently offer long-term 0% APR—transferring your debt to these can save you a lot in interest. Just read the fine print to make sure the 0% rate lasts at least 12 months.

5. Defer or Refinance Your Mortgage

Many people worry about rent or mortgage payments during a layoff or hours cut. USA Today reports that Fannie Mae, Freddie Mac, and the Department of Housing and Urban Development suspended eviction and foreclosure proceedings until at least the end of April (during the pandemic).

If you’ve lost your job or had your hours reduced and can’t make monthly payments, contact your lender right away. You might qualify for mortgage deferral, where lenders pause payments during tough circumstances.

Now might also be a good time to refinance your mortgage if current rates are lower than what you’re paying. Websites like Credible.com let you get quotes from multiple lenders in minutes.

6. Apply for Unemployment Benefits

If you do lose your job, apply for unemployment benefits immediately. Note that each state runs its own program, so there’s no universal process.

The Department of Labor’s Career One Stop is a quick way to learn about your state’s benefits. Laws are also being updated to help those affected by the pandemic—for example, you can now apply for unemployment if:

- Your employer temporarily shuts down due to COVID-19

- You’re quarantined after exposure to COVID-19 and plan to return to work

- You leave your job over fear of exposure or to care for an ill family member

You can file for unemployment online or by phone. Organize necessary documents beforehand to save time—requirements vary by state but may include:

- Your Social Security number

- Personal info like your address and phone number

- Your bank’s routing number and your checking account number

- Your employer’s name, address, and phone number

- Exact employment dates

- Recent pay stubs

- Emails from your boss or company about layoffs or hours cuts

Freelancers or contract workers usually can’t apply for unemployment, but it’s worth trying—some states are updating rules to include them. If a national disaster is declared due to the pandemic, you may qualify for Disaster Unemployment Assistance.

If you apply, you might face issues with the application in some areas. NPR reports that many states’ unemployment websites keep crashing due to high demand. Keep trying, or apply during off-peak times like late at night.

7. Review Your Cellphone Plan

For most people, a cellphone is a necessary expense—you’ll need it to look for jobs and stay in touch. Luckily, there are ways to cut your cellphone bill.

One way is switching to a prepaid plan: U.S. News & World Report says this can save you $30+ a month. Prepaid carriers charge for a set amount of minutes/data and still offer decent nationwide coverage. Verizon, AT&T, Cricket, Straight Talk, and Boost Mobile all have prepaid options. Check Consumer Reports’ analysis of low-cost plans to save more.

Look at your data usage too. If you often pay overage fees, upgrading your data limit might be worth it. But if you’re willing to use Wi-Fi instead of cell data for web surfing, lowering your limit can reduce your bill. You could also switch to Ting, where you only pay for the talk, text, and data you actually use each month.

Many carriers are suspending penalties, late fees, and service cuts during the pandemic, and some are offering all users unlimited minutes or data. Check your carrier’s website to see how they’re helping customers.

8. Start Networking

Everyone’s situation is different—some will update their resume and start job hunting right away, while others might take time to be a stay-at-home parent or brush up on career skills during quarantine.

Whatever your plans, use your network of friends and colleagues—especially when job hunting. Use Facebook and LinkedIn for professional networking—they can be great for finding new opportunities.

9. Find New Income Streams

The pandemic is affecting every industry, and hiring has slowed or stopped at many companies. But some companies are still hiring, and there are ways to earn money.

One option is switching to a recession-proof industry like healthcare, law enforcement, or senior care. Some less obvious sectors are also hiring—for example, grocery stores are hiring more due to increased food stockpiling.

You could also find a work-from-home job or side gig that keeps you and others safe. In-demand side gigs during the pandemic might include online tutoring (through companies like VIPKid or Education First), corporate cleaning services, or food delivery (via DoorDash) for older adults or those who can’t leave home.

While earning extra income is important during job loss, make sure to stay safe—wash your hands often, avoid touching your face when job hunting. If you get a job, ask about the company’s pandemic safety procedures.

Home

detail

Financial Readiness: Preparing for and Managing Unemployment or Job Loss

2025-08-27T14:48:42

Losing or leaving a job can be an extremely stressful experience, even if you’ve taken all possible steps to prepare. That said, the more you do to save money and boost your self-sufficiency now, the easier it will be to get through an unstable economic period and come out on top.

How to Get Your Finances Ready for Job Loss

Most of the time, people don’t see a job loss coming—it hits as an unwelcome surprise. Luckily, there are plenty of steps you can take right now to prepare for potential layoffs or a significant cut in working hours.

1. Adjust and Cut Back Your Budget

If you’re worried about job loss and don’t have a monthly household budget, create one right away. If your current budget is based on your old income, go through it and reevaluate your expenses to fit your possible new situation.

Trim as much as you can from your spending. Ideas for saving money on a tight budget include:

- Canceling cable and switching to cheaper streaming services like Disney+, Amazon Prime Video, Hulu, or Netflix.

- Raising your car and home insurance deductibles to lower your monthly premiums.

- Cutting off any subscriptions—magazines, streaming services, or subscription boxes—and using tools like Truebill to spot forgotten ones you’re still paying for.

- Keeping the AC off or the heat turned down to save on utility bills.

- Turning off lights to reduce your electric bill.

If you’re worried about affording essential services like electricity, internet, gas, or water amid the ongoing pandemic, call your provider and explain your situation. USA Today reports that many cities and private companies are pausing service disconnections for nonpayment, waiving late fees, offering flexible payment plans, or even letting customers delay payments entirely.

2. Build Up Your Emergency Fund

If you don’t have an emergency fund yet, learn how to start one by putting money into a high-yield savings account—banks like CIT Bank offer good options. If you already have one, make sure it covers 3–6 months of your family’s expenses. Whenever possible, put every dollar you cut from your budget straight into this fund.

Chances are the pandemic has changed your daily life significantly—and like most people, you’re probably not doing many of the things you used to. While it might feel frustrating to give up these activities or purchases, they’re a chance to grow your emergency fund further.

Think about everything you used to do before the pandemic that you’re not doing now, and redirect that money to your fund. For example:

- Going out for drinks with coworkers after work

- Dining out at restaurants

- Attending concerts or sports games

- Taking vacations

- Buying new clothes

- Grabbing a latte before work

If you’re working from home during the pandemic, for instance, you’re not spending money on gas for your commute—start putting that weekly gas money into your emergency fund. Or if you used to spend $25 a week on lunch with colleagues, add that to the fund too.

You could also use your tax refund to build the fund, or the stimulus checks the federal government issued in response to the pandemic. CNBC notes that the federal government planned to send $1,200 checks to most Americans within a few weeks [at the time of writing]. If you don’t need this money for rent, mortgage, or groceries, use it to kick-start your emergency fund.

3. Plan for Health Insurance

According to the Kaiser Family Foundation, 49% of Americans get their health insurance through their employer. So what happens if you lose your job?

First, if you get a severance package, read the details carefully to see if you can sign up for COBRA—a group insurance plan your employer may offer if you’ve been laid off or had your hours cut.

You can also apply for coverage through the federal government’s health insurance marketplace. Job loss counts as a “life change” that qualifies you for special enrollment, so you can apply even if open enrollment is closed.

You might also qualify for Medicaid—each state has its own requirements based on income and family size. If there’s a cash-only doctor in your area, that’s another option: many charge a flat monthly fee for unlimited services like office visits or phone consultations, with the fee depending on your location and family size.

4. Pay Down Debt

Getting out of debt—especially high-interest debt—should be a top priority before losing your job, and there are ways to tackle credit card debt quickly. Do what you can to pay off current debt, or transfer high-interest debt to a credit card with a lower APR. If you’re still employed, find ways to earn extra income now and use that to pay down debt.

You could also contact your credit card company to explain your situation. The New York Times reports that some lenders are offering temporary hardship help, like letting you make interest-only payments, waiving interest entirely, or even pausing payments for a set time.

If you own a home and have good credit, consider applying for a home equity line of credit (HELOC) before losing your job—it can be hard or impossible to get one once you’re unemployed. You don’t have to use the funds right away, but it gives you access to cash for paying off high-interest credit cards or buying groceries.

U.S. News & World Report notes that using a HELOC to pay off credit card debt can lower interest payments significantly. But keep in mind: if you default on the HELOC, you risk losing your home, so weigh the pros and cons carefully.

Some credit cards currently offer long-term 0% APR—transferring your debt to these can save you a lot in interest. Just read the fine print to make sure the 0% rate lasts at least 12 months.

5. Defer or Refinance Your Mortgage

Many people worry about rent or mortgage payments during a layoff or hours cut. USA Today reports that Fannie Mae, Freddie Mac, and the Department of Housing and Urban Development suspended eviction and foreclosure proceedings until at least the end of April (during the pandemic).

If you’ve lost your job or had your hours reduced and can’t make monthly payments, contact your lender right away. You might qualify for mortgage deferral, where lenders pause payments during tough circumstances.

Now might also be a good time to refinance your mortgage if current rates are lower than what you’re paying. Websites like Credible.com let you get quotes from multiple lenders in minutes.

6. Apply for Unemployment Benefits

If you do lose your job, apply for unemployment benefits immediately. Note that each state runs its own program, so there’s no universal process.

The Department of Labor’s Career One Stop is a quick way to learn about your state’s benefits. Laws are also being updated to help those affected by the pandemic—for example, you can now apply for unemployment if:

- Your employer temporarily shuts down due to COVID-19

- You’re quarantined after exposure to COVID-19 and plan to return to work

- You leave your job over fear of exposure or to care for an ill family member

You can file for unemployment online or by phone. Organize necessary documents beforehand to save time—requirements vary by state but may include:

- Your Social Security number

- Personal info like your address and phone number

- Your bank’s routing number and your checking account number

- Your employer’s name, address, and phone number

- Exact employment dates

- Recent pay stubs

- Emails from your boss or company about layoffs or hours cuts

Freelancers or contract workers usually can’t apply for unemployment, but it’s worth trying—some states are updating rules to include them. If a national disaster is declared due to the pandemic, you may qualify for Disaster Unemployment Assistance.

If you apply, you might face issues with the application in some areas. NPR reports that many states’ unemployment websites keep crashing due to high demand. Keep trying, or apply during off-peak times like late at night.

7. Review Your Cellphone Plan

For most people, a cellphone is a necessary expense—you’ll need it to look for jobs and stay in touch. Luckily, there are ways to cut your cellphone bill.

One way is switching to a prepaid plan: U.S. News & World Report says this can save you $30+ a month. Prepaid carriers charge for a set amount of minutes/data and still offer decent nationwide coverage. Verizon, AT&T, Cricket, Straight Talk, and Boost Mobile all have prepaid options. Check Consumer Reports’ analysis of low-cost plans to save more.

Look at your data usage too. If you often pay overage fees, upgrading your data limit might be worth it. But if you’re willing to use Wi-Fi instead of cell data for web surfing, lowering your limit can reduce your bill. You could also switch to Ting, where you only pay for the talk, text, and data you actually use each month.

Many carriers are suspending penalties, late fees, and service cuts during the pandemic, and some are offering all users unlimited minutes or data. Check your carrier’s website to see how they’re helping customers.

8. Start Networking

Everyone’s situation is different—some will update their resume and start job hunting right away, while others might take time to be a stay-at-home parent or brush up on career skills during quarantine.

Whatever your plans, use your network of friends and colleagues—especially when job hunting. Use Facebook and LinkedIn for professional networking—they can be great for finding new opportunities.

9. Find New Income Streams

The pandemic is affecting every industry, and hiring has slowed or stopped at many companies. But some companies are still hiring, and there are ways to earn money.

One option is switching to a recession-proof industry like healthcare, law enforcement, or senior care. Some less obvious sectors are also hiring—for example, grocery stores are hiring more due to increased food stockpiling.

You could also find a work-from-home job or side gig that keeps you and others safe. In-demand side gigs during the pandemic might include online tutoring (through companies like VIPKid or Education First), corporate cleaning services, or food delivery (via DoorDash) for older adults or those who can’t leave home.

While earning extra income is important during job loss, make sure to stay safe—wash your hands often, avoid touching your face when job hunting. If you get a job, ask about the company’s pandemic safety procedures.