Each year, we conduct a survey of our millionaire clients. Some findings align with common assumptions: their average household income stands at $330,132 this year, and the typical value of their homes exceeds $1 million. Yet other habits of these wealthy individuals defy stereotypes—they’re not the “traditional millionaire behaviors” most people imagine. In this article, I’ll break down key habits and traits of millionaires that anyone can adopt, no matter their current income or net worth.

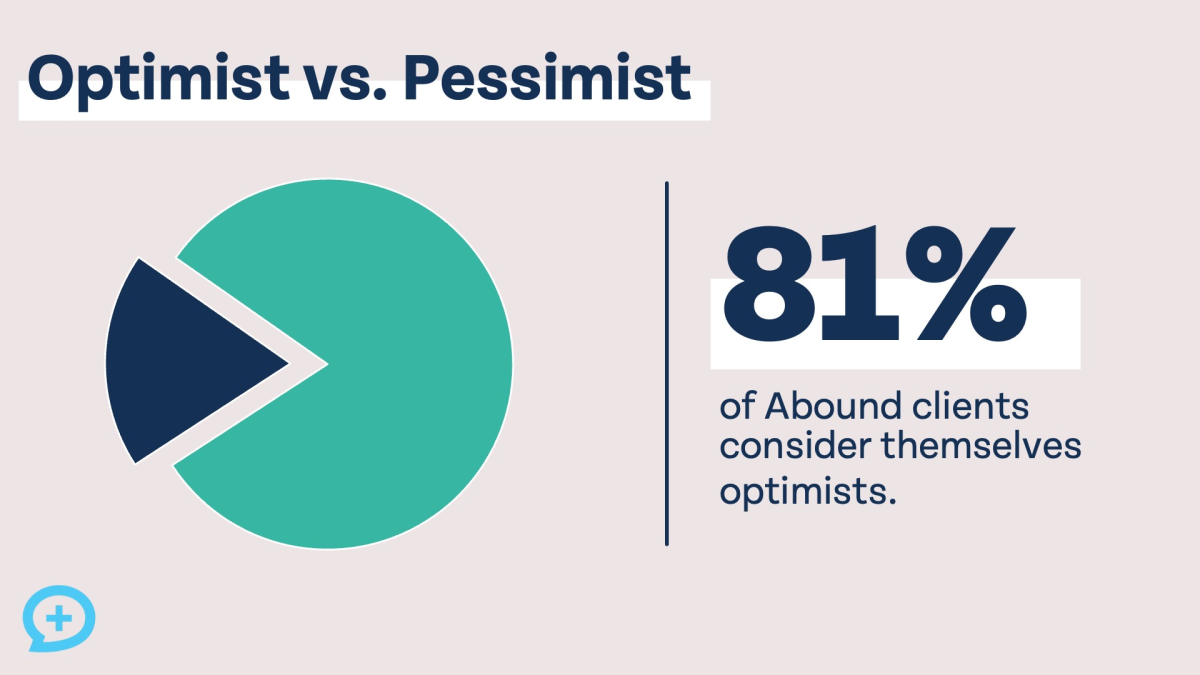

1. Millionaires Are Consistent Optimists

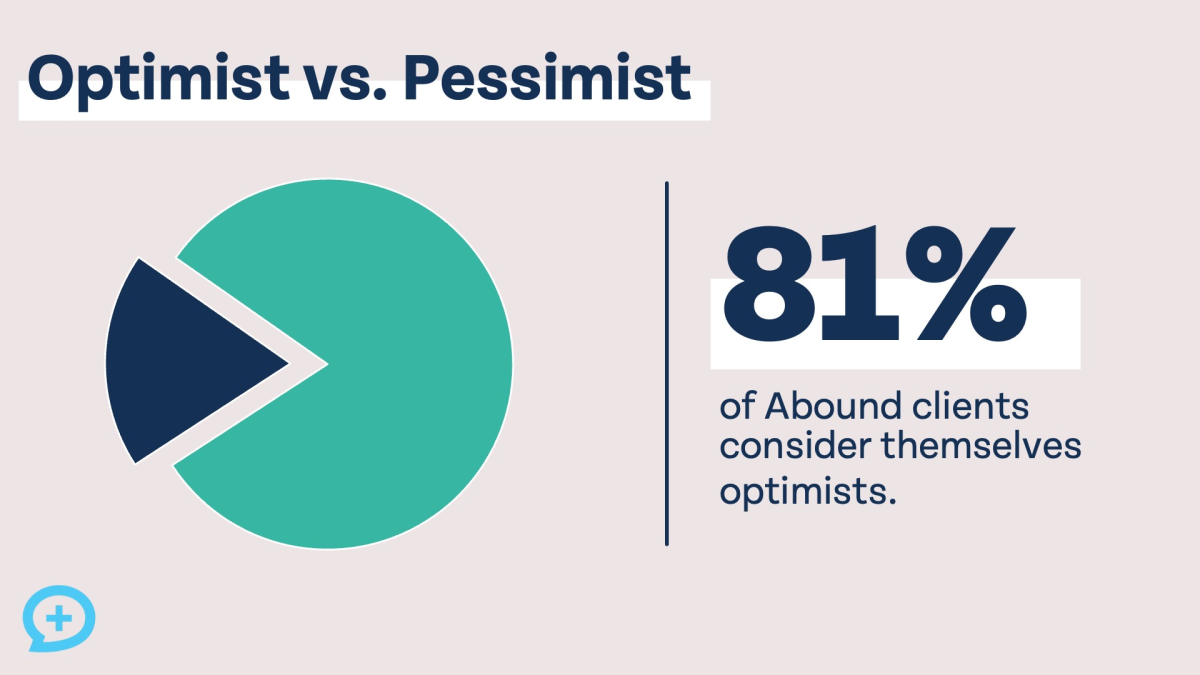

Year after year, our survey reveals an overwhelming trend: nearly all our millionaire clients identify as optimists. This shouldn’t be entirely shocking, as research consistently links optimism to greater financial success. But what if you lean more toward pessimism? You can’t rewrite your personality overnight to become an optimist, but you can gradually shift your mindset through practices like regular gratitude exercises.

Optimism doesn’t mean ignoring reality or viewing life through “rose-tinted glasses,” either. You can acknowledge problems in your personal life or the world at large while still working to create change. True optimistic thinking boils down to believing you have the power to improve your life—and your finances. The biggest issue with a pessimistic mindset isn’t that it reflects the “truth” about you or the world; it’s that it often fosters fatalism—the belief that your actions don’t make a difference.

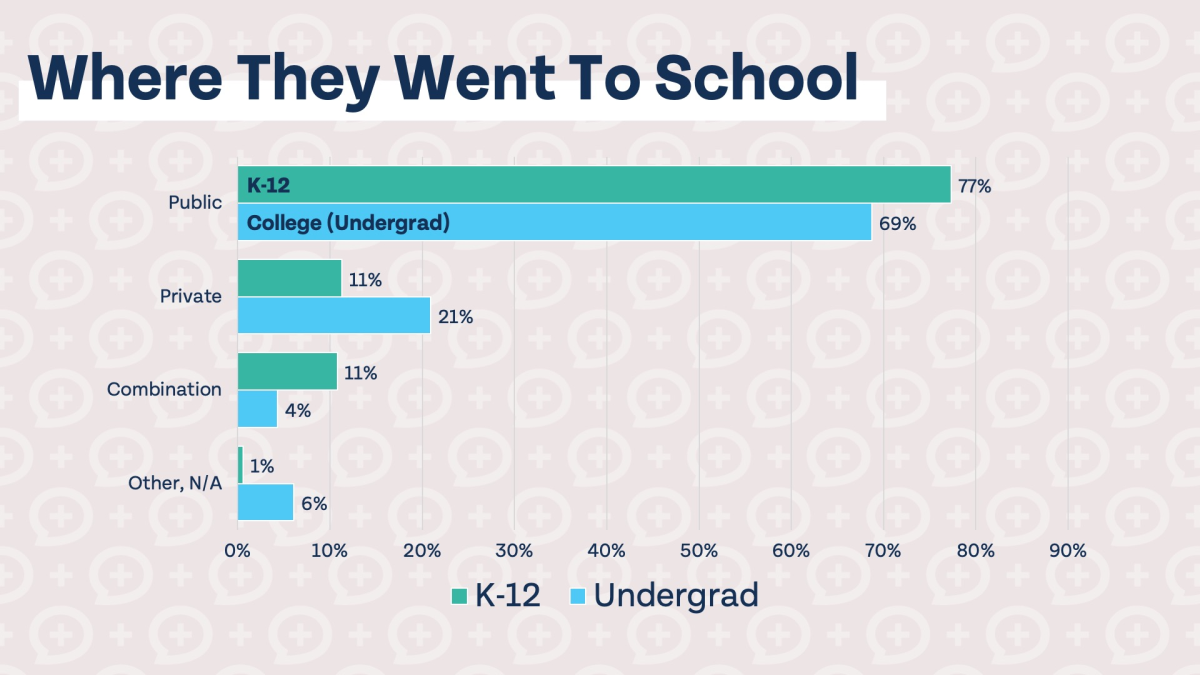

2. Private School Isn’t a Requirement for Success

Only 9% of U.S. children attend private school, yet a large majority of Americans believe private schools offer better education than public ones. It’s easy to see why: studies often show private school students score higher on the SAT than their public school peers. But one critical study painted a different picture: when researchers adjusted for a key variable—family income—there was no statistically significant difference in academic performance between private and public school students.

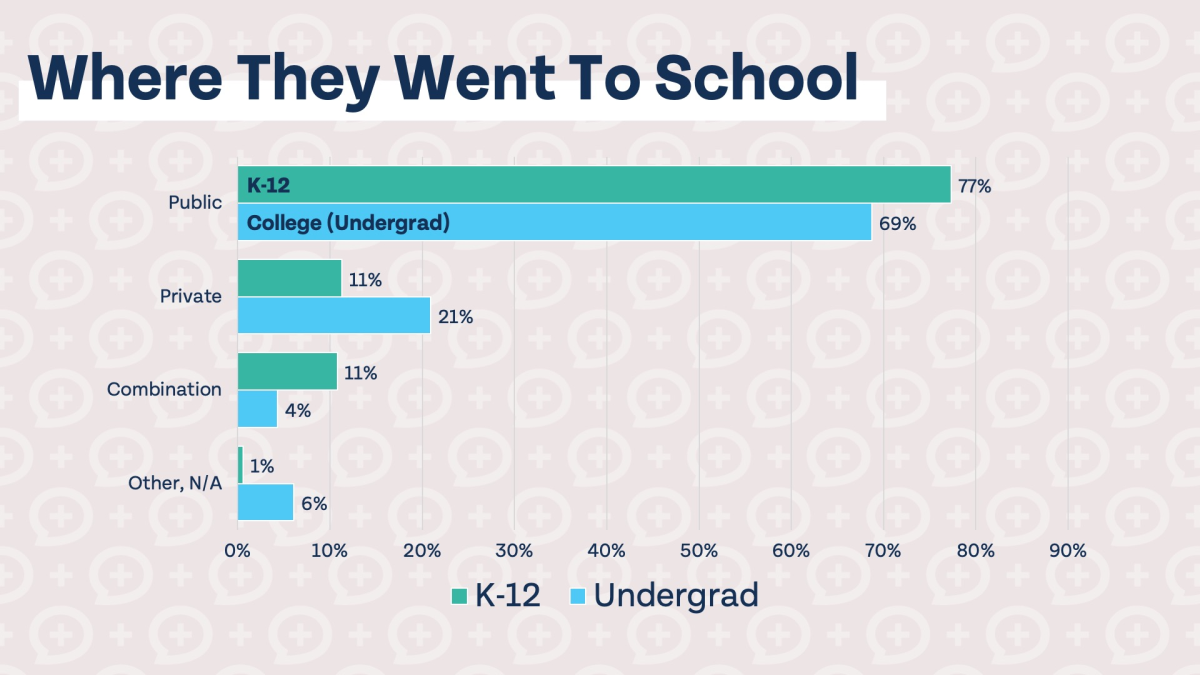

The gap in performance often comes down to selection bias, not the schools themselves. Private education is expensive; if a family can afford it, their children likely already have advantages (like access to resources, tutoring, or stable home environments) that put them ahead. Our millionaire survey reinforces this: 77% of respondents attended public schools from kindergarten through 12th grade, and 69% went on to public universities. Private school, it turns out, isn’t a prerequisite for achieving wealth.

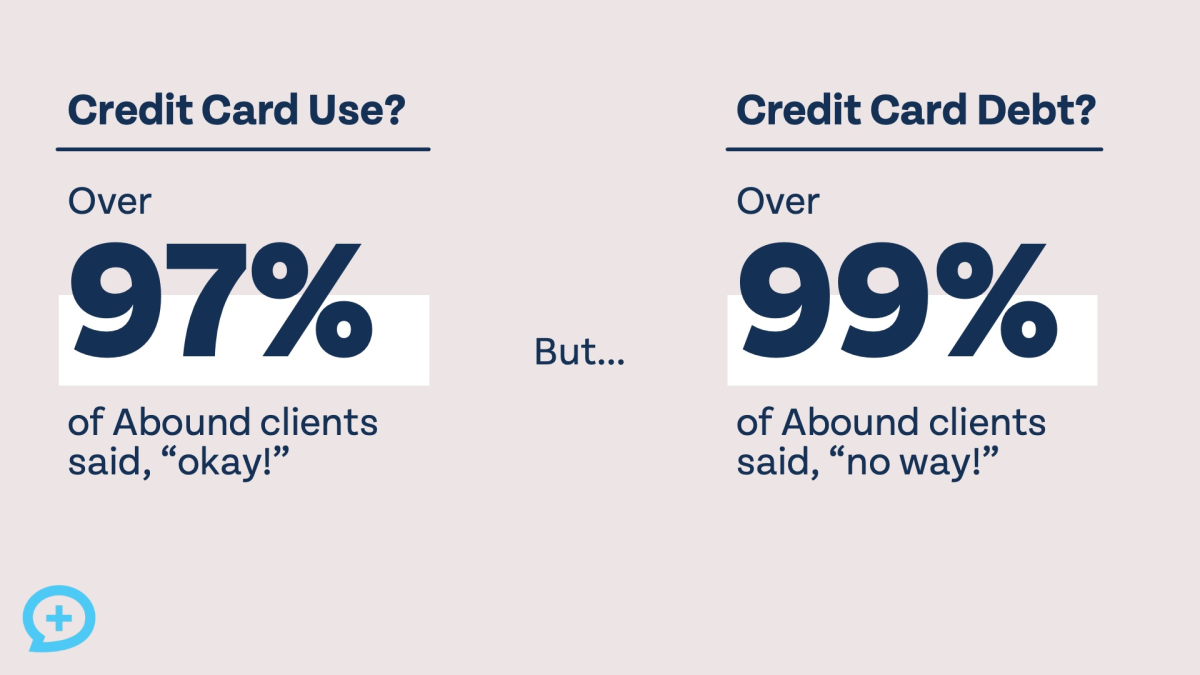

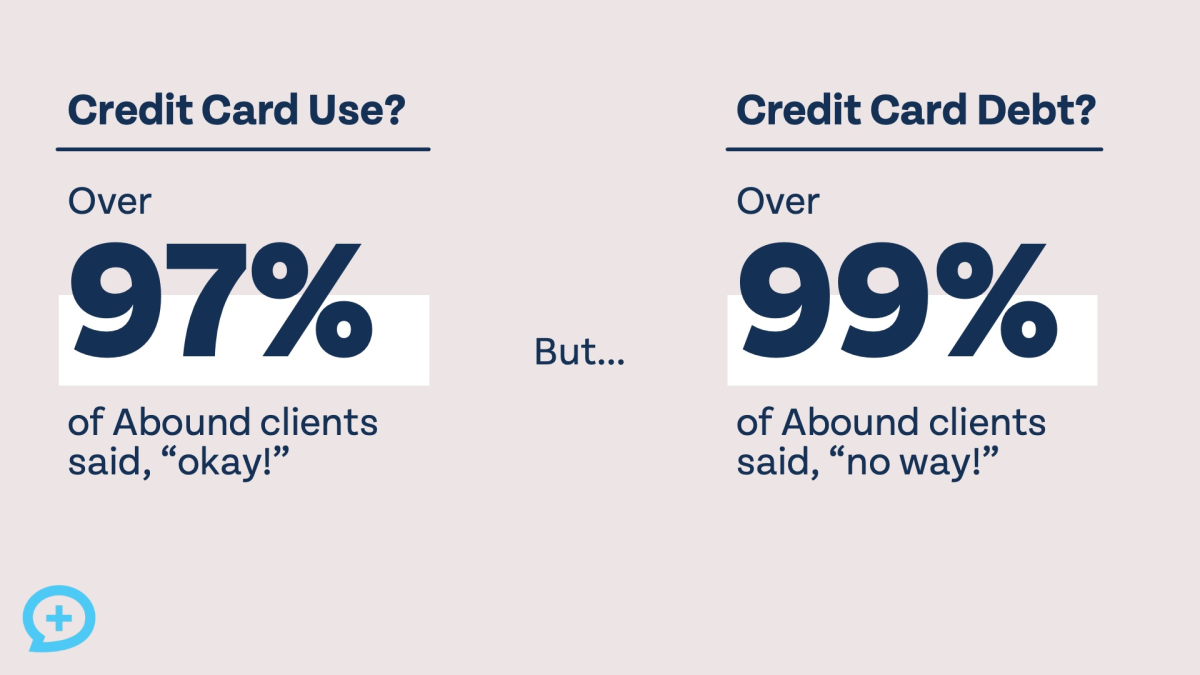

3. Credit Cards Are Fine—Credit Card Debt Is Not

Why do millionaires use credit cards? As I’ve noted before, credit cards are powerful financial tools—and millionaires know how to use them wisely. The rule is simple: never use credit cards to live beyond your means.

Credit cards outperform cash or debit cards in nearly every way: they offer stronger fraud protection, reward points or cashback, and often include perks like extended warranties, price-matching guarantees, and travel insurance. But these benefits only matter if you use credit cards with the same discipline as cash or debit. If you carry a balance and accumulate credit card debt, those perks quickly become irrelevant—even costly.

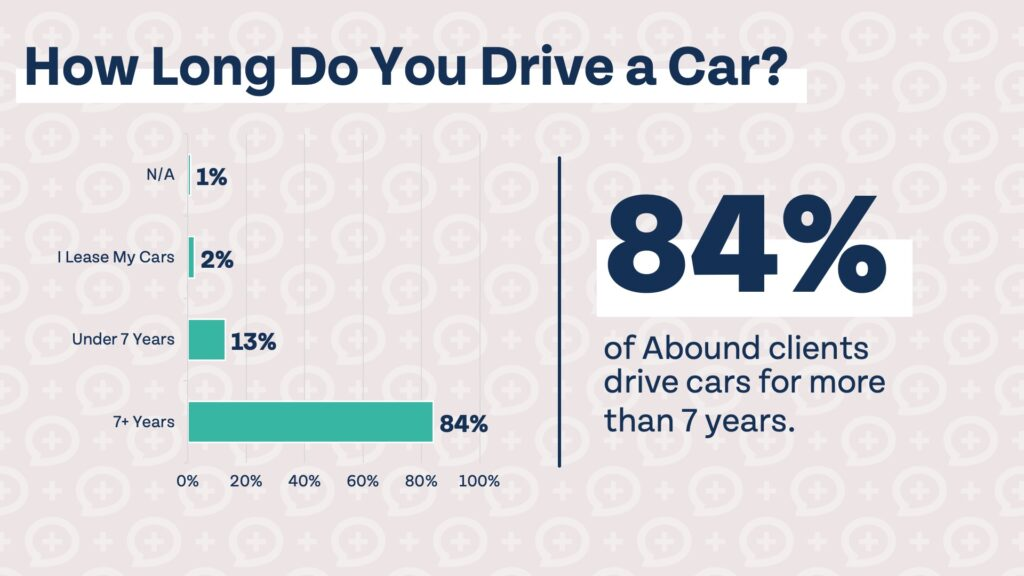

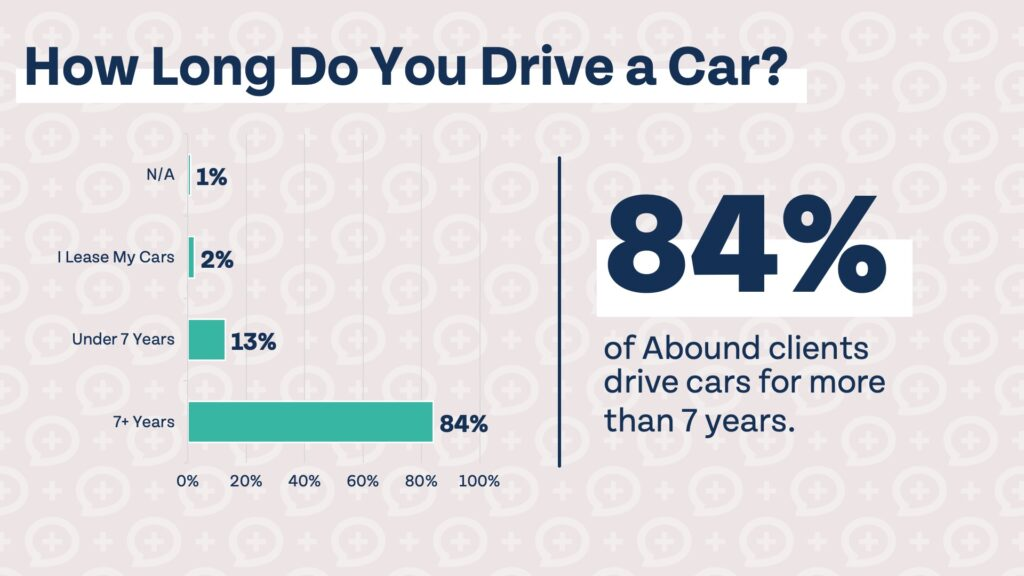

4. They Keep Cars Until They’re No Longer Practical

When you picture a “millionaire,” you might imagine someone driving a brand-new luxury car. But our survey tells a different story: most of our millionaire clients keep their cars for seven years or more. This makes financial sense: cars are depreciating assets, and they lose value fastest in the first 3–5 years. The longer you keep a car, the more value you get out of your initial investment—you avoid the steep depreciation hit of buying new, and you minimize costs like registration, insurance, and maintenance for a second vehicle.

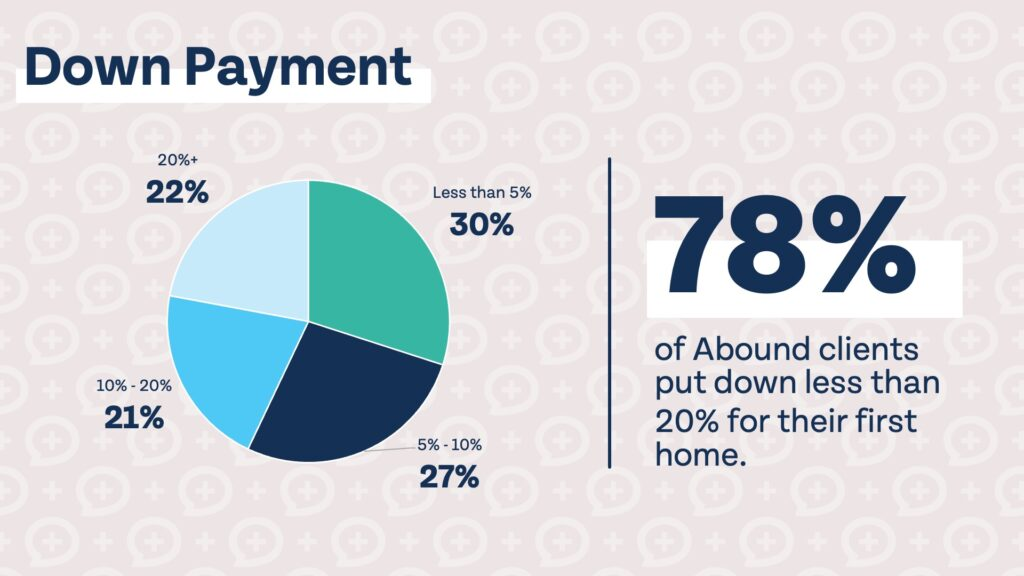

5. 20% Down Payments Aren’t Mandatory for First Homes

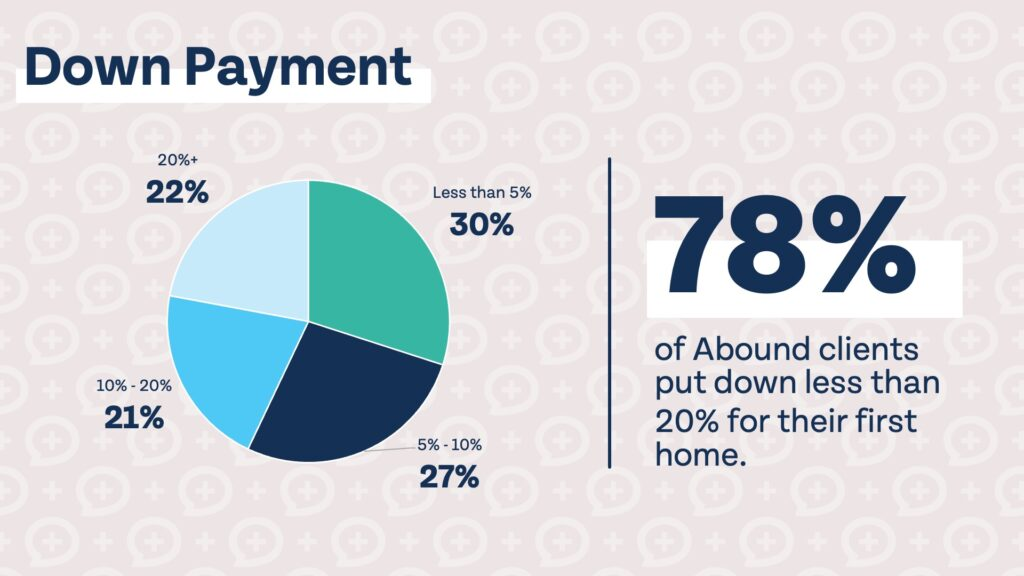

A 20% down payment on a first home is often hailed as the “ideal” choice: it protects you from home price drops and lowers your monthly mortgage payment. But with the median U.S. home price now over $400,000, saving 20% (that’s $80,000 or more) is unrealistic for many first-time buyers. Our survey shows you’re not alone if you can’t swing it: 78% of our millionaire clients didn’t put 20% down on their first home.

You don’t need a 20% down payment—but you should follow some basic rules to avoid overextending yourself:

- Stick to the 3/5/25 rule: Aim for a down payment of at least 3–5%, keep your monthly mortgage payment below 25% of your gross income, and plan to live in the home for 5–7 years (especially if you put down less than 20%, to avoid losing money if you sell early).

- For subsequent homes, aim for a 20% down payment to build more equity and reduce costs.

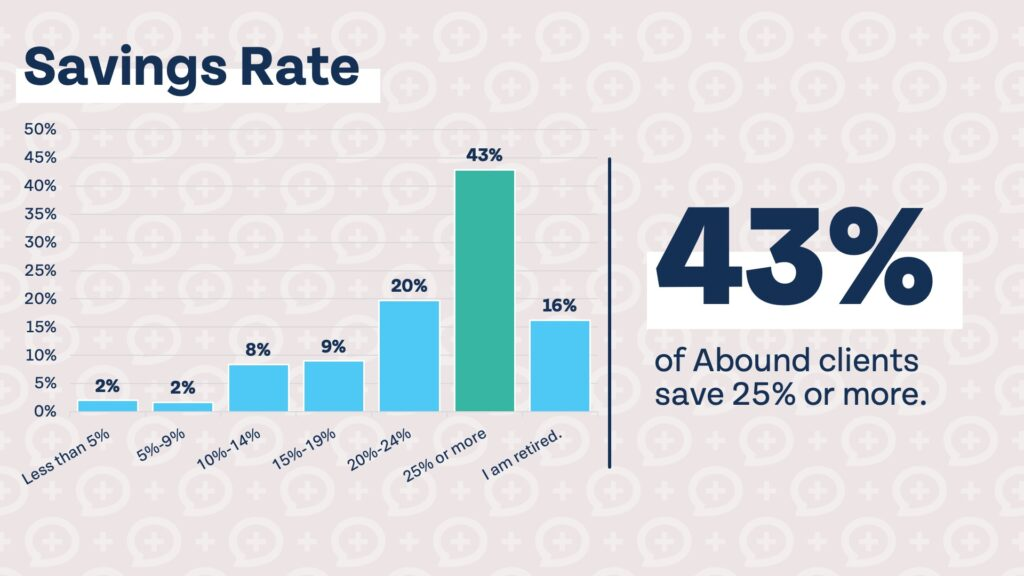

6. They Invest 25% or More of Income for Retirement

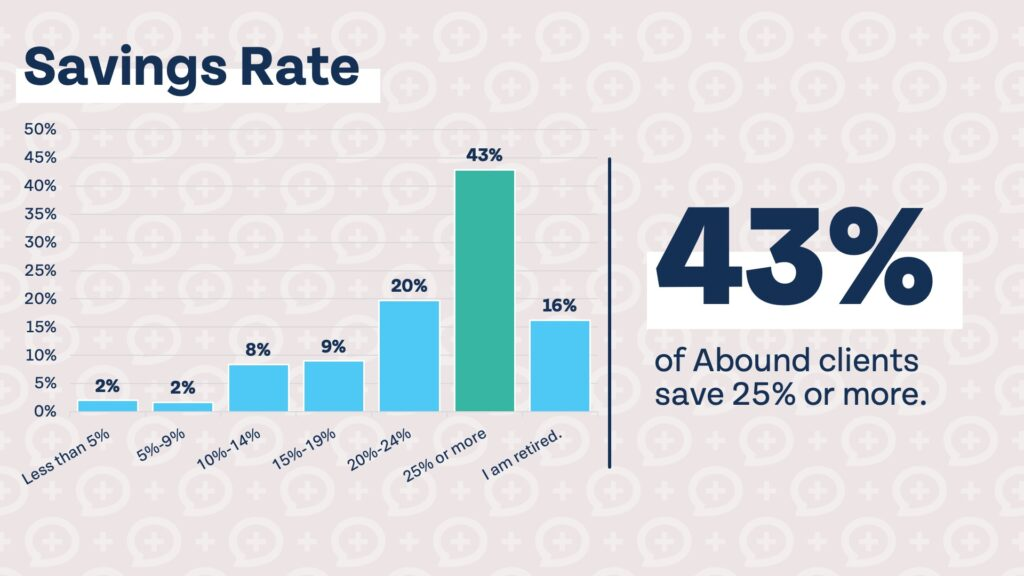

It’s no secret that millionaires are good at saving—but our survey highlights a specific habit: most of our clients either invest 25% or more of their income for retirement, or they’re already retired (and built their wealth through consistent saving).

Investing heavily for retirement isn’t a “secret trick”—it’s a foundational step toward financial success. Think of it like brushing your teeth to prevent cavities, or eating well and exercising to stay healthy: it’s a simple, consistent action that pays off over time.

The Truth About Millionaires: Habits Over Hype

Public perception of millionaires often misses the mark. The wealthy individuals we survey aren’t defined by private school degrees, luxury cars, or huge down payments. Instead, they’re optimists who prioritize long-term thinking: they attend public schools, use credit cards responsibly, keep cars for years, don’t stress over 20% down payments on first homes, and invest aggressively for retirement.

The best part? None of these habits require a six-figure income or a million-dollar net worth to adopt. Whether you’re already on track to build wealth or currently have a negative net worth, incorporating these behaviors into your life can help you jumpstart your financial journey.

Home

detail

Millionaire Habits Revealed

2025-09-23T10:35:37

Each year, we conduct a survey of our millionaire clients. Some findings align with common assumptions: their average household income stands at $330,132 this year, and the typical value of their homes exceeds $1 million. Yet other habits of these wealthy individuals defy stereotypes—they’re not the “traditional millionaire behaviors” most people imagine. In this article, I’ll break down key habits and traits of millionaires that anyone can adopt, no matter their current income or net worth.

1. Millionaires Are Consistent Optimists

Year after year, our survey reveals an overwhelming trend: nearly all our millionaire clients identify as optimists. This shouldn’t be entirely shocking, as research consistently links optimism to greater financial success. But what if you lean more toward pessimism? You can’t rewrite your personality overnight to become an optimist, but you can gradually shift your mindset through practices like regular gratitude exercises.

Optimism doesn’t mean ignoring reality or viewing life through “rose-tinted glasses,” either. You can acknowledge problems in your personal life or the world at large while still working to create change. True optimistic thinking boils down to believing you have the power to improve your life—and your finances. The biggest issue with a pessimistic mindset isn’t that it reflects the “truth” about you or the world; it’s that it often fosters fatalism—the belief that your actions don’t make a difference.

2. Private School Isn’t a Requirement for Success

Only 9% of U.S. children attend private school, yet a large majority of Americans believe private schools offer better education than public ones. It’s easy to see why: studies often show private school students score higher on the SAT than their public school peers. But one critical study painted a different picture: when researchers adjusted for a key variable—family income—there was no statistically significant difference in academic performance between private and public school students.

The gap in performance often comes down to selection bias, not the schools themselves. Private education is expensive; if a family can afford it, their children likely already have advantages (like access to resources, tutoring, or stable home environments) that put them ahead. Our millionaire survey reinforces this: 77% of respondents attended public schools from kindergarten through 12th grade, and 69% went on to public universities. Private school, it turns out, isn’t a prerequisite for achieving wealth.

3. Credit Cards Are Fine—Credit Card Debt Is Not

Why do millionaires use credit cards? As I’ve noted before, credit cards are powerful financial tools—and millionaires know how to use them wisely. The rule is simple: never use credit cards to live beyond your means.

Credit cards outperform cash or debit cards in nearly every way: they offer stronger fraud protection, reward points or cashback, and often include perks like extended warranties, price-matching guarantees, and travel insurance. But these benefits only matter if you use credit cards with the same discipline as cash or debit. If you carry a balance and accumulate credit card debt, those perks quickly become irrelevant—even costly.

4. They Keep Cars Until They’re No Longer Practical

When you picture a “millionaire,” you might imagine someone driving a brand-new luxury car. But our survey tells a different story: most of our millionaire clients keep their cars for seven years or more. This makes financial sense: cars are depreciating assets, and they lose value fastest in the first 3–5 years. The longer you keep a car, the more value you get out of your initial investment—you avoid the steep depreciation hit of buying new, and you minimize costs like registration, insurance, and maintenance for a second vehicle.

5. 20% Down Payments Aren’t Mandatory for First Homes

A 20% down payment on a first home is often hailed as the “ideal” choice: it protects you from home price drops and lowers your monthly mortgage payment. But with the median U.S. home price now over $400,000, saving 20% (that’s $80,000 or more) is unrealistic for many first-time buyers. Our survey shows you’re not alone if you can’t swing it: 78% of our millionaire clients didn’t put 20% down on their first home.

You don’t need a 20% down payment—but you should follow some basic rules to avoid overextending yourself:

- Stick to the 3/5/25 rule: Aim for a down payment of at least 3–5%, keep your monthly mortgage payment below 25% of your gross income, and plan to live in the home for 5–7 years (especially if you put down less than 20%, to avoid losing money if you sell early).

- For subsequent homes, aim for a 20% down payment to build more equity and reduce costs.

6. They Invest 25% or More of Income for Retirement

It’s no secret that millionaires are good at saving—but our survey highlights a specific habit: most of our clients either invest 25% or more of their income for retirement, or they’re already retired (and built their wealth through consistent saving).

Investing heavily for retirement isn’t a “secret trick”—it’s a foundational step toward financial success. Think of it like brushing your teeth to prevent cavities, or eating well and exercising to stay healthy: it’s a simple, consistent action that pays off over time.

The Truth About Millionaires: Habits Over Hype

Public perception of millionaires often misses the mark. The wealthy individuals we survey aren’t defined by private school degrees, luxury cars, or huge down payments. Instead, they’re optimists who prioritize long-term thinking: they attend public schools, use credit cards responsibly, keep cars for years, don’t stress over 20% down payments on first homes, and invest aggressively for retirement.

The best part? None of these habits require a six-figure income or a million-dollar net worth to adopt. Whether you’re already on track to build wealth or currently have a negative net worth, incorporating these behaviors into your life can help you jumpstart your financial journey.