“You don’t manage your finances, and your finances won’t look after you.” How do you manage your finances? Do you know how Germans do it? It is hoped that this article can give you some inspiration.

As a high-income country, Germany has a generally affluent population, yet personal investment and financial management activities among Germans are unusually sluggish. Where do Germans’ money go? What are their preferred ways of managing finances? And what kinds of investment and financial management are acceptable to them?

How do Germans invest and manage their finances?

Germany is a highly developed industrial country with no urban-rural gap, and people are generally well-off. Logically, in such a high-income country, the financial industry should be highly developed and personal investment and financial management activities extremely active, but the reality is quite different. I once asked German friends around me: “Have you ever done any investment and financial management?” More than half of them replied: “I have never done any investment.” When I asked: “Not even bought any stocks?” They still shook their heads.

German friends told me that historically, nearly 40% of Germans have dabbled in investment, but they not only failed to make money but even suffered losses, and many of them then gave up so-called investment. I asked quite a few Germans: Do you have any plans to invest in the future? Almost all the answers I got were negative. I told them that in China, there are investment instruments with an annualized rate of return of 30% or even as high as 50%. Upon hearing this, they actually burst into laughter. They think that even if there have been high returns, it is just a huge trap, and sooner or later, one will fall into it. Germans do not believe that high returns and security can coexist; therefore, they do not listen to investment myths and will not easily participate in such activities.

Among the respondents, fewer than 10% are still engaged in investment and financial management. Their investment channels are no more than bonds and stocks, with only a small number of people involved in foreign exchange trading. Most of those who buy bonds prefer government-issued public bonds, and some also purchase corporate bonds. Although as many as 80% of Germans have savings in banks, the deposit amounts are not large. Data from the German Banking Association shows that saving is Germans’ favorite way of investment, and they put an average of 12% of their income into savings. “Why save? That’s what my parents and grandfather did.” Most Germans take it for granted to deposit a portion of their monthly salary in the bank. They believe that their elders, through frugality and consistent saving after World War II, enabled the next generation to live a prosperous life.

Ordinary people rarely buy stocks of listed companies because stocks are also high-risk investment products. Historically, Germany has experienced stock market crashes, and many Germans suffered heavy losses. For Germans, who are 向来 known for being rational and calm, these risky investment experiences have left a lasting impression. They understand that there is no such thing as getting rich overnight in the stock market. As for internet finance, many have never even heard of it. In short, investment and financial management activities in Germany are not extensive, and in comparison to China, their scale is much smaller.

Where do Germans spend their money?

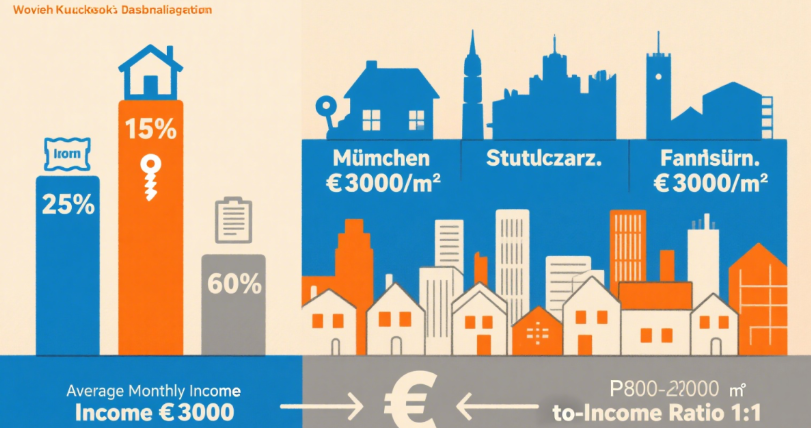

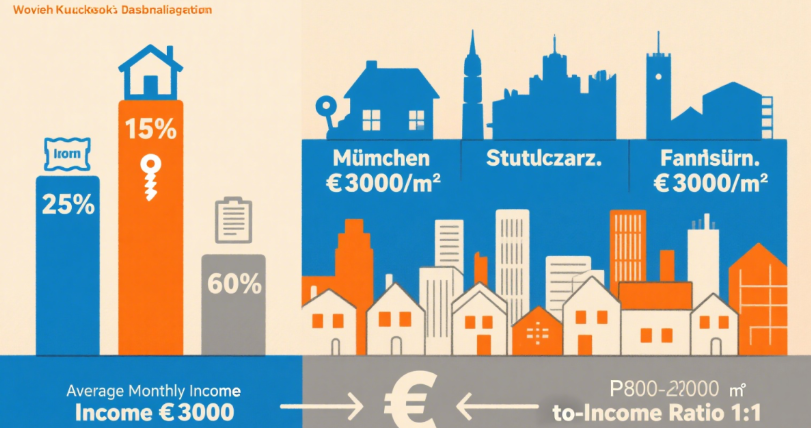

Among the four basic living expenses—clothing, food, housing, and transportation—the proportion of clothing and food is extremely small, while housing and transportation account for a large share. Germans spend a significant amount of money on housing, cars, and travel for vacations, among other things. More than 60% of Germans do not buy houses but choose to rent. Why is renting so common in Germany? The reason is simple: renting is more cost-effective than buying a house.

Approximately 15% of Germans have inherited property from their ancestors, so they neither need to buy nor rent a house. From this, it can be inferred that only about 25% of Germans purchase housing. The most expensive housing prices in Germany are in cities such as Munich, Stuttgart, and Frankfurt. Even in the most expensive areas, housing prices are no more than 3,000 euros per square meter, and in most cities, they range from 800 to 2,000 euros per square meter. The average monthly income of Germans is 3,000 euros.

There is a pattern in where Germans live: the wealthier they are, the less they live in high-rise buildings in the city center. Instead, they buy houses in unpolluted suburban areas, mostly country villas.

Why are Germans not keen on property speculation?

A significant reason is that real estate has extremely poor liquidity. Coupled with tax factors, selling a property may even result in a loss. What’s more, tying up a large sum of money in real estate is not worthwhile from a business perspective.

Beyond housing, another major expense falls under “transportation”. Basically, German households have almost reached a level of one car per person, and car prices range from several thousand euros to several hundred thousand euros.

In the second-hand car market, people can buy old cars for just a few hundred or a few thousand euros. For particularly wealthy individuals, luxury cars priced from tens of thousands to hundreds of thousands of euros are not uncommon. In Germany, the biggest cost of driving is not fuel, but parking fees. Street parking costs around 2 euros per hour, and although underground parking lots are slightly cheaper, they still amount to tens of euros a day—no small burden.

In the broader sense of “transportation”, a large portion of Germans’ spending goes to vacation travel. July and August each year are fixed vacation months for Germans, which are almost planned a year in advance. The wealthiest travel to the Americas, Asia, or even Africa; those with moderate means go to other European countries, especially Mallorca in Spain and the southern regions of France; and those with less money have to settle for traveling within the country. Germans are quite concerned about their reputation—even those who can’t afford a proper trip will try to get a tan, just to make their neighbors think they’ve been to some far-off place.

Since Germans mainly spend their money on basic needs like food, clothing, housing, and transportation, they don’t have much spare money left. This is precisely why most Germans simply don’t have the funds for investment and financial management.

Paying various social insurance premiums is, in a way, how Germans manage their finances.

Another significant expense for Germans is insurance. The comprehensive insurance system provides Germans with a stable living environment, but a large portion of their monthly income has to go toward social insurance premiums. Employed Germans pay the following percentages of their monthly income for different insurances: 14% for health insurance, 2% for long-term care insurance, 19% for pension insurance, and 6% for unemployment insurance. Some companies also offer corporate pensions—additional pension plans bought by the company for employees, which count as extra benefits.

In addition to mandatory social insurance, individuals can also voluntarily purchase commercial pension insurance. All freelancers who don’t have to pay mandatory pension contributions, as well as other groups with such needs, can freely choose commercial pension plans. Due to the growing aging problem in German society, the imbalance in the population structure caused by a shrinking young population and a rising elderly population has led to a strain on public pension funds.

Why don’t Germans like investing in stocks?

Generally speaking, most Germans turn to banks for financial advice. Due to the high risks of stocks, Germans are not very enthusiastic about investing in them; instead, they prefer to put their money into safer government bonds. Only if they have a lot of “spare cash” will Germans consider buying stocks.

“Germans have a tradition of avoiding risks,” said Rudolph, an economist at the University of Cologne, attributing Germans’ lack of interest in stocks to historical reasons. Germany has gone through two world wars and currency turmoil, so it has a lingering wariness of high-risk investment methods. The German culture also doesn’t embrace the American-style “overnight millionaire” stock market dream. The latest report from the German Stock Institute in Frankfurt shows that in the United States, one out of every two citizens invests in stocks; in European countries like the UK and Switzerland, about one-fifth of the population buys stocks; while in Germany, it’s good if one out of ten people does so.

Why don’t wealthy people keep their “spare money” in the bank?

This is because interest rates in German banks are incredibly low. Take Deutsche Bank as an example: in 2015, the interest rate for current accounts at Deutsche Bank was only 0.35%—10,000 euros would earn just 35 euros in interest after a year, making the total principal and interest 10,035 euros. Even fixed-term deposit rates are low. To make matters worse, according to predictions from Commerzbank, the European Central Bank may even lower the current account interest rate to -0.1%. This doesn’t matter much to ordinary depositors with little money, but for large deposits, the loss can be significant—not to mention the additional loss from inflation.

Although Germany has a developed industrial sector, activities like personal investment and social fund-raising are not particularly active. To a large extent, this is because bank loan interest rates in Germany are extremely low, at less than 2% per year. Therefore, companies would rather take out loans from banks than seek personal investment or social fund-raising. What’s more, German banks don’t discriminate against small and medium-sized enterprises, and it’s not difficult for small businesses to get loans.

At the same time, bank loan procedures are not complicated. Banks can engage in both deposit and loan businesses as well as securities businesses, which makes companies feel that raising funds directly in the securities market is not as simple and convenient as taking out a bank loan. Since the main channel for German companies to raise funds is the banking system, direct financing through listing on the stock market is not their primary choice—and this has also kept the scale of Germany’s stock market relatively small.

Home

detail

No stock trading, no house buying—see how Germans manage their finances!

2025-08-26T16:55:37

“You don’t manage your finances, and your finances won’t look after you.” How do you manage your finances? Do you know how Germans do it? It is hoped that this article can give you some inspiration.

As a high-income country, Germany has a generally affluent population, yet personal investment and financial management activities among Germans are unusually sluggish. Where do Germans’ money go? What are their preferred ways of managing finances? And what kinds of investment and financial management are acceptable to them?

How do Germans invest and manage their finances?

Germany is a highly developed industrial country with no urban-rural gap, and people are generally well-off. Logically, in such a high-income country, the financial industry should be highly developed and personal investment and financial management activities extremely active, but the reality is quite different. I once asked German friends around me: “Have you ever done any investment and financial management?” More than half of them replied: “I have never done any investment.” When I asked: “Not even bought any stocks?” They still shook their heads.

German friends told me that historically, nearly 40% of Germans have dabbled in investment, but they not only failed to make money but even suffered losses, and many of them then gave up so-called investment. I asked quite a few Germans: Do you have any plans to invest in the future? Almost all the answers I got were negative. I told them that in China, there are investment instruments with an annualized rate of return of 30% or even as high as 50%. Upon hearing this, they actually burst into laughter. They think that even if there have been high returns, it is just a huge trap, and sooner or later, one will fall into it. Germans do not believe that high returns and security can coexist; therefore, they do not listen to investment myths and will not easily participate in such activities.

Among the respondents, fewer than 10% are still engaged in investment and financial management. Their investment channels are no more than bonds and stocks, with only a small number of people involved in foreign exchange trading. Most of those who buy bonds prefer government-issued public bonds, and some also purchase corporate bonds. Although as many as 80% of Germans have savings in banks, the deposit amounts are not large. Data from the German Banking Association shows that saving is Germans’ favorite way of investment, and they put an average of 12% of their income into savings. “Why save? That’s what my parents and grandfather did.” Most Germans take it for granted to deposit a portion of their monthly salary in the bank. They believe that their elders, through frugality and consistent saving after World War II, enabled the next generation to live a prosperous life.

Ordinary people rarely buy stocks of listed companies because stocks are also high-risk investment products. Historically, Germany has experienced stock market crashes, and many Germans suffered heavy losses. For Germans, who are 向来 known for being rational and calm, these risky investment experiences have left a lasting impression. They understand that there is no such thing as getting rich overnight in the stock market. As for internet finance, many have never even heard of it. In short, investment and financial management activities in Germany are not extensive, and in comparison to China, their scale is much smaller.

Where do Germans spend their money?

Among the four basic living expenses—clothing, food, housing, and transportation—the proportion of clothing and food is extremely small, while housing and transportation account for a large share. Germans spend a significant amount of money on housing, cars, and travel for vacations, among other things. More than 60% of Germans do not buy houses but choose to rent. Why is renting so common in Germany? The reason is simple: renting is more cost-effective than buying a house.

Approximately 15% of Germans have inherited property from their ancestors, so they neither need to buy nor rent a house. From this, it can be inferred that only about 25% of Germans purchase housing. The most expensive housing prices in Germany are in cities such as Munich, Stuttgart, and Frankfurt. Even in the most expensive areas, housing prices are no more than 3,000 euros per square meter, and in most cities, they range from 800 to 2,000 euros per square meter. The average monthly income of Germans is 3,000 euros.

There is a pattern in where Germans live: the wealthier they are, the less they live in high-rise buildings in the city center. Instead, they buy houses in unpolluted suburban areas, mostly country villas.

Why are Germans not keen on property speculation?

A significant reason is that real estate has extremely poor liquidity. Coupled with tax factors, selling a property may even result in a loss. What’s more, tying up a large sum of money in real estate is not worthwhile from a business perspective.

Beyond housing, another major expense falls under “transportation”. Basically, German households have almost reached a level of one car per person, and car prices range from several thousand euros to several hundred thousand euros.

In the second-hand car market, people can buy old cars for just a few hundred or a few thousand euros. For particularly wealthy individuals, luxury cars priced from tens of thousands to hundreds of thousands of euros are not uncommon. In Germany, the biggest cost of driving is not fuel, but parking fees. Street parking costs around 2 euros per hour, and although underground parking lots are slightly cheaper, they still amount to tens of euros a day—no small burden.

In the broader sense of “transportation”, a large portion of Germans’ spending goes to vacation travel. July and August each year are fixed vacation months for Germans, which are almost planned a year in advance. The wealthiest travel to the Americas, Asia, or even Africa; those with moderate means go to other European countries, especially Mallorca in Spain and the southern regions of France; and those with less money have to settle for traveling within the country. Germans are quite concerned about their reputation—even those who can’t afford a proper trip will try to get a tan, just to make their neighbors think they’ve been to some far-off place.

Since Germans mainly spend their money on basic needs like food, clothing, housing, and transportation, they don’t have much spare money left. This is precisely why most Germans simply don’t have the funds for investment and financial management.

Paying various social insurance premiums is, in a way, how Germans manage their finances.

Another significant expense for Germans is insurance. The comprehensive insurance system provides Germans with a stable living environment, but a large portion of their monthly income has to go toward social insurance premiums. Employed Germans pay the following percentages of their monthly income for different insurances: 14% for health insurance, 2% for long-term care insurance, 19% for pension insurance, and 6% for unemployment insurance. Some companies also offer corporate pensions—additional pension plans bought by the company for employees, which count as extra benefits.

In addition to mandatory social insurance, individuals can also voluntarily purchase commercial pension insurance. All freelancers who don’t have to pay mandatory pension contributions, as well as other groups with such needs, can freely choose commercial pension plans. Due to the growing aging problem in German society, the imbalance in the population structure caused by a shrinking young population and a rising elderly population has led to a strain on public pension funds.

Why don’t Germans like investing in stocks?

Generally speaking, most Germans turn to banks for financial advice. Due to the high risks of stocks, Germans are not very enthusiastic about investing in them; instead, they prefer to put their money into safer government bonds. Only if they have a lot of “spare cash” will Germans consider buying stocks.

“Germans have a tradition of avoiding risks,” said Rudolph, an economist at the University of Cologne, attributing Germans’ lack of interest in stocks to historical reasons. Germany has gone through two world wars and currency turmoil, so it has a lingering wariness of high-risk investment methods. The German culture also doesn’t embrace the American-style “overnight millionaire” stock market dream. The latest report from the German Stock Institute in Frankfurt shows that in the United States, one out of every two citizens invests in stocks; in European countries like the UK and Switzerland, about one-fifth of the population buys stocks; while in Germany, it’s good if one out of ten people does so.

Why don’t wealthy people keep their “spare money” in the bank?

This is because interest rates in German banks are incredibly low. Take Deutsche Bank as an example: in 2015, the interest rate for current accounts at Deutsche Bank was only 0.35%—10,000 euros would earn just 35 euros in interest after a year, making the total principal and interest 10,035 euros. Even fixed-term deposit rates are low. To make matters worse, according to predictions from Commerzbank, the European Central Bank may even lower the current account interest rate to -0.1%. This doesn’t matter much to ordinary depositors with little money, but for large deposits, the loss can be significant—not to mention the additional loss from inflation.

Although Germany has a developed industrial sector, activities like personal investment and social fund-raising are not particularly active. To a large extent, this is because bank loan interest rates in Germany are extremely low, at less than 2% per year. Therefore, companies would rather take out loans from banks than seek personal investment or social fund-raising. What’s more, German banks don’t discriminate against small and medium-sized enterprises, and it’s not difficult for small businesses to get loans.

At the same time, bank loan procedures are not complicated. Banks can engage in both deposit and loan businesses as well as securities businesses, which makes companies feel that raising funds directly in the securities market is not as simple and convenient as taking out a bank loan. Since the main channel for German companies to raise funds is the banking system, direct financing through listing on the stock market is not their primary choice—and this has also kept the scale of Germany’s stock market relatively small.